Originally published at: Should I buy or rent? – Personal Finance Club

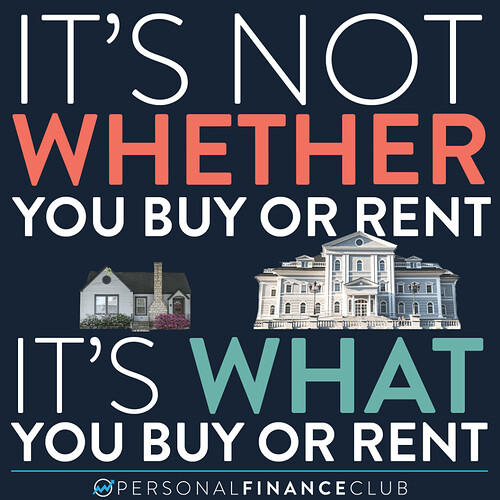

Whenever I point out the costs associated with homeownership the pitchforks come out and some commenters accuse me of being wrong that renting is always better. But I didn’t say renting is always better! My point is that rent OR buy, what matters most is how much you’re actually spending on your primary residence. Because rent or buy, you’re going to burn a lot of money on where you live (whether it’s on rent or mortgage interest, taxes, insurance, realtor fees, maintenance, etc).

Can buying be better? Absolutely. If you buy modestly and stay in the same home for over 5 years, it’s usually financially better than renting the equivalent property. Can renting be better? Yep. If you move a lot, have a screaming deal on rent or live in a market with a very high purchase price to rent ratio, there’s no reason to force yourself into a huge real estate purchase that’s going to cost you way more money.

Think about your own life. If you own, how does the first house you bought compare to the last property you rented? If you rent and you’re thinking about buying, how does the property you’re thinking about compare to the place you’re renting? For most new homeowners, their first home purchase represents a BIG step up in housing costs. Apartment living is efficient. Shared land, shared walls, shared utilities, etc. It’s cheaper for the tenants and still meat on the bone for the landlord to make a profit. When you move from an apartment to a house, you’re taking on all those expenses yourself.

So when you’re deciding where to live, rent or buy is largely a lifestyle choice. The financial choice is HOW MUCH property you rent or buy. The lower you keep your expenses, the more you’ll have left to invest and build wealth!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram