Originally published at: Should I invest in the S&P 500 or in a target date index fund? – Personal Finance Club

One of the questions I get most often is “Should I invest in the S&P 500 or in a target date index fund?”

First, let’s understand what those are. The S&P 500 is basically a list of the 500 biggest companies in the US. If you buy an S&P 500 index fund you’re investing in those 500 stocks (in proportion to their size). Historically, the S&P 500 has performed great, providing about a 10% per year return over the last 100 years. I often use it in examples due to its simplicity and long, readily available track record.

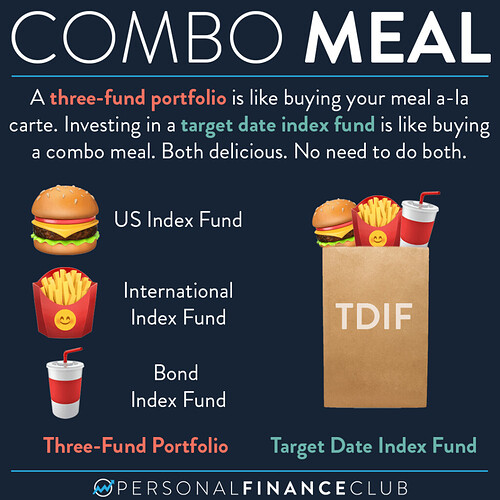

A target date index fund has the S&P 500 index fund inside of it! It also includes the rest of the smaller stocks in the US, plus an non-US index fund, plus a bond index fund.

So it doesn’t really make sense to invest in both. If you want all the other stuff, you might as well just buy the target date index fund. If you’re gung ho on just buying large US stocks, then stick with an S&P 500 index fund.

I think they’ll both do great going forward. Which one will do better? I have no idea because I can’t see the future. But for me, I like the diversification. I don’t want to end up in a situation where I pick a losing horse. And if large US companies have a bad next 10 or 20 years, and international does amazing, I’ll wish I was more diversified.

I’m ok with not having the BEST returning portfolio in 20 years. In fact, I’m sure I WON’T have the best performing portfolio. Someone will pick and choose stocks or ETFs, get lucky, and beat me. But I am sure my portfolio will do great and likely outperform 90% of other investors. I can do all that while sleeping like a baby at night and never making a trade other than putting more money into a TDIF.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram