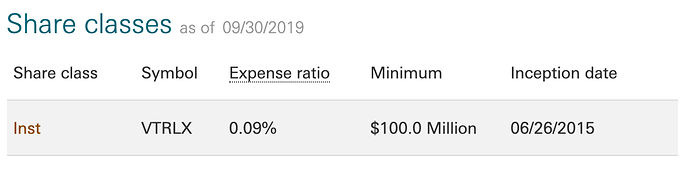

Hi! I opened up a target date index fund 2055 with findelity fund (FDEWX) with vanguard

- I see so many posts about the s&p 500. Would it make sense to put half into my target date index fund and the other half into s&p to diversify? Why or why not?

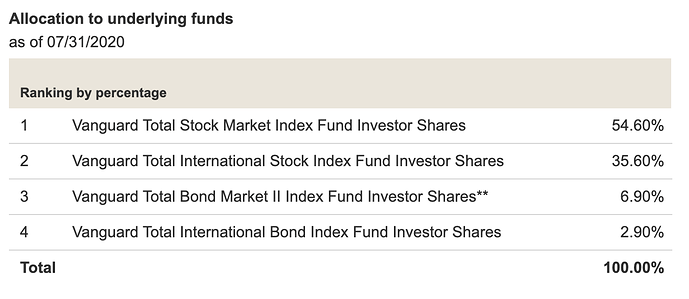

- I heard that at times the s & p 500 is already Incldued in target date index funds. How do I look this up? I tried on vanguard and didn’t have any luck

Thanks!