Originally published at: https://www.personalfinanceclub.com/the-debt-snowball-method/

If you have any debt, other than your mortgage, I think you should put 100% focus on paying it off before you start investing. I know that sounds crazy to some, but think about the situation in reverse. What if you were 100% debt FREE. Would you walk into a bank, borrow your current amount of debt, go invest it and start making payments to the bank. I hope not. But that’s the decision your making every time you put money into an investment instead of paying down your debt.

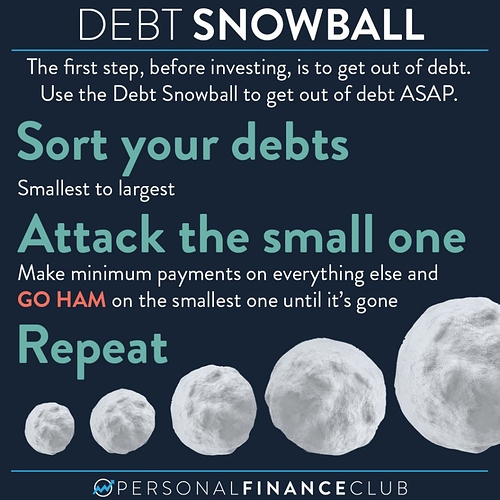

I love the debt snowball method. At heart I’m a math nerd and an emotionless robot. And in theory, someone like me should not prefer the snowball method. Because mathematically, all other things held equal, you’ll actually pay off debt slightly faster if you sort by interest rate, not debt size. But here’s why I like attacking the smallest debt first, regardless of interest rate:

★ It provides faster emotional wins. When you go from five debts to four debts you feel the momentum and adds to your resolve to get debt free.

★ It opens up cash flow. When you get rid of that first debt, that’s a full payment you never have to make again. That means even BIGGER payments getting thrown at your next smallest debt. (It starts to snow ball… get it)

★ It’s nearly as fast. If you’re going HAM on these debts (as you should) the subtle differences between how you attack them will barely matter in the end.

★ Not about the math. It’s about habits, emotions, motivation, etc. Seeing debt after debt disappear results in better emotional outcomes and a higher likelihood to be debt free!

I know I talk mostly about investing on this page, but if you’re in debt, do this first. Go HAM on those debts. Get nuts. Dial your expenses down to nothing. Pick up a side hustle. Throw massive eye-watering payments at those debts. Then when you’re debt free, convert those debt payments to investment contributions and you’re rich.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means (that means not being in debt!) and 2.) Invest early and often.

– Jeremy

via Instagram