Originally published at: https://www.personalfinanceclub.com/the-layers-of-investing-why-ira-vs-index-funds-doesnt-make-sense/

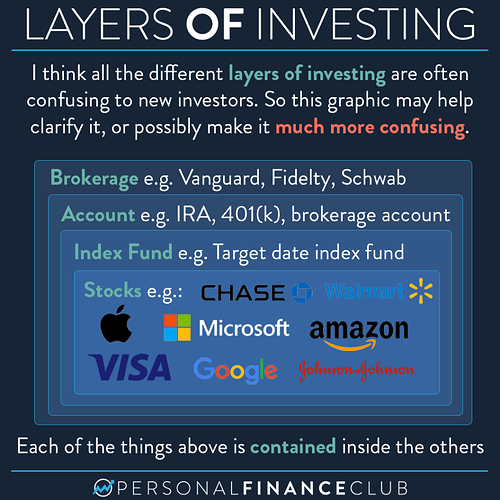

I think getting these different “layers” confused is the absolute number one most common confusion in investing. So let’s walk through what happens when you invest.

1. You go to a brokerage website (e.g. Vanguard.com)

2. You open an account (e.g. a Roth IRA)… now your Roth IRA is with/inside of Vanguard.

3. You contribute money to your Roth IRA and buy a target date index fund (TDIF). Now you own a TDIF that’s inside of your Roth IRA that’s inside of Vanguard.

4. Inside of your TDIF is thousands of stocks. So now you own Microsoft stock (plus thousands more)… that’s inside of your TDIF… that’s inside of your Roth IRA… that’s inside of Vanguard.

MAKES SENSE? So here’s a list of questions that I get every day that make no sense:

• What’s better a Roth IRA or an index fund? (That makes no sense… you need both. An index fund goes inside of a Roth IRA)

• Should I invest in Vanguard or in a Roth IRA? (That makes no sense. You would open your Roth IRA with Vanguard)

• Do you prefer an S&P 500 index fund or a 401(k)? (That makes no sense. A 401(k) is a type of account and index funds go in the account)

• Can you watch my cat while I’m at work and my mom is out of town? (That makes no sense. I live three states away and you’re 32 years old. You shouldn’t even be living with your mom. Get your shit together, Chad)

So there it is. Maybe this graphic helps clarify things. Or maybe it makes it much more confusing. Either way, the point is you need to get your own place and figure out your cat situation ASAP.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy