Originally published at: This is the single most important factor when it comes to investing – Personal Finance Club

Every day of my life I get dozens of questions like these:

• Roth or traditional?

• Index fund or ETF?

• Fidelity or Vanguard?

• Robo-advisor or DIY?

• TDIF or three-fund portfolio?

• MLM or permanent life insurance?

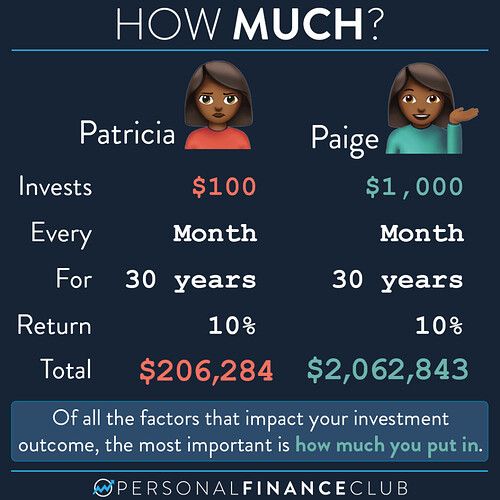

And while I respect the quest to learn about the ins and outs of investing I think it’s really important to remember that the factor that is more important than all of the small details is how much money you put in. Investing 10X more money per month, given the same rate of return and the same time frame, will result in 10X more money at the end. Someone who buys and hold random stocks in a robinhood account with 10X more money, is likely gonna end up with a LOT more money than someone who perfectly invests 1/10th the money in low fee index funds inside a Roth IRA. Brutal, I know. (Of course, it’s preferential to do both things right)

And if you’re wondering about my answers to the questions above:

• Doesn’t really matter.

• Doesn’t really matter.

• Doesn’t really matter.

• Doesn’t really matter.

• Doesn’t really matter.

• For the love of god, neither.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram