Originally published at: This is what my first Roth IRA at 18 turned into – Personal Finance Club

One of the rules of the Roth IRA is that you can’t contribute more than $6,000 per year, but you also can’t contribute more than you’re earned income. i.e. If you’re not working, you’re not allowed to come up with money to contribute to an IRA.

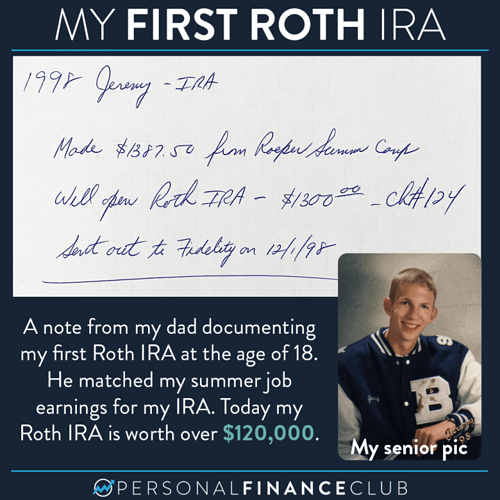

My dad knew this rule and when I had a summer job at 17 years old he cleverly opened a Roth IRA for me. He was kind enough to let me keep my $1,387 I earned at my job and gifted me the $1,300 as an IRA contribution. This note shows how we opened a Fidelity account. We chose a single mutual fund to invest in. This was before index funds were as popular as they are today, so we chose the Fidelity Fund (FFIDX). (To Fidelity Fund’s credit, it has actually kept pace with the S&P 500 over the last 20+ years!)

That $1,300 has since grown to about $7,800. Not life changing stuff by itself, but a 6X return over 23 years isn’t bad. But on top of that $1,300, I started making my own contributions over the years which allowed my IRA to grow to over $120,000! So the real gift wasn’t the initial contribution, but the education and habit of investing that has paid off!

I’d like to point out how incredibly lucky, fortunate, privileged, etc I was as a child to have this type of opportunity. Most children don’t. It’s certainly no credit to me. I just won the birth lottery by having parents who were successful and thoughtful enough to help me out in this way. If you’re a parent and you have the means, you could help your teen open an IRA when they get their first job. If you’re a parent and your own finances aren’t in order yet, you can still give them the gift I received by setting a good example and talking to them about money, debt, and investing.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram