Hi everyone!

Let me start thanking all the sharing of the wisdom and motivation to help us all improve our personal finances!

I’m a non-us follower of the PFC, and I’ve composed a portfolio around the 3 basic ETFs of diversification (US, nonUS, bonds)* - there are no target date funds available in the market.

Triggered by the VXUS performance -kinda poor-, I started to try to understand why was performing like that, but ran into a more interesting article which I wanted to share here and get some thoughts.

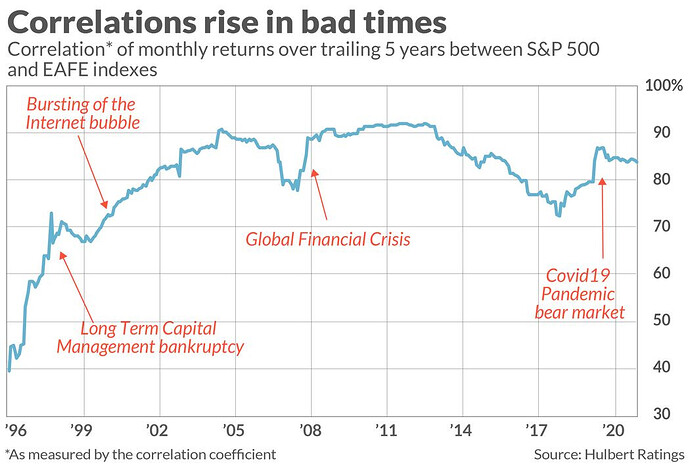

A question mark of how much diversification does VXUS (or a similar nonUS one) really offers. The statement is : it’s diversified for the good times and not so much when we have bad times. (below more on the source).

I was interested to gather thoughts around if this is something that makes it worth to rethink the 3 basic ETF porfolio as a diversification strategy. I’m debating myself with it for a while now.

Many thanks and have a HAPPY HAPPY holidays :0)

Best,

José Manuel

From CL.

"U.S. and international stocks are least correlated during bull markets, and they become highly correlated during bear markets and crashes. These features greatly reduce the benefits of international diversification, since it would be better if just the opposite were the case."

This is the article:

The 3 fund portfolio I’m referencing;