Two part question…Do I have to pay capital gains on stocks that I sell if I do not transfer the profit but rather reinvest it into the market? Second question is, if I buy into an index fund how does that work? I see the prices of it but is it similar to buying a stock? Say for example the current price of one is 250 and I invest 1000 into it, does that mean I have 4 shares of it?

Depends on the type of account. If it’s in a tax advantaged account (IRA, 401k, etc) then no. If it’s in a regular/taxable brokerage account, then yes.

Basically, yeah! But index funds are a type of mutual funds, and they’re designed to make it a little easier on the investor. You make your investment in dollars, not shares. And the brokerage keeps track of how many shares you own. So in your example, exactly right, but usually it doesn’t end up being a round number like that. More like you invest $1,000 and the current share price is $27.35 so you end up with 36.563 shares. You can see how many shares you own in your account, but it’s kind of irrelevant. The value of what you have in the fund is what counts.

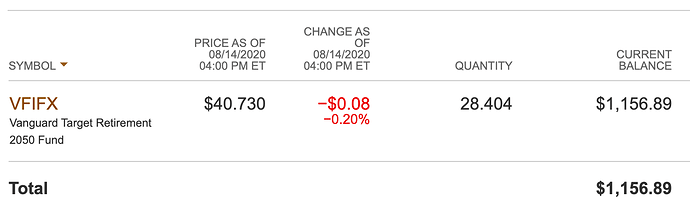

Here’s a look at my Vanguard account:

You can see I technically own 28.404 shares of VFIFX. But all I really care about is I put in $1,000 and now I have 1,156.89 share! Note that the share amount will go up automatically if you have “reinvest dividends” turned on. When your index fund pays out dividends, it just goes and buys more shares of the same to amplify that compound growth!