What do you think of VDIGX? It was recently reopened to new investors last year. I have the 3-fund Vanguard portfolio (VTSAX, VBTLX, VTIAX) in my brokerage, but added VDIGX per recommendation from my dad. I also have VDIGX in my Vanguard Roth IRA instead of a target date fund. The expense ratio is 0.27%, higher than 0.04%, but it still seems like a good investment even though it’s not an index fund. I know VDADX is similar with only a 0.08% expense ratio, but I picked VDIGX.

Hey Di!

Well, I wouldn’t want to disagree with your dad as I’m sure he’s a very wise man! The 0.27% expense ratio is a LITTLE higher, but still in the “low” range, so it’s not something I’m offended by. That fund is a “Vanguard Dividend Growth Fund”, according to the VDIGX prospectus page, “This fund is designed to provide investors with some income while offering exposure to dividend-focused companies across all industries.” That fund only actually has 40 companies.

IN MY OPINION, owning just 40 “good dividend stocks” is kind of an old fashioned way of thinking about investing. By owning just those 40 stocks in that fund, you’re missing out on all other sorts of stocks and sectors which might provide large future growth. You also might be exposing yourself to greater volatility if those 40 companies are disproportionately impacted by some future economic event.

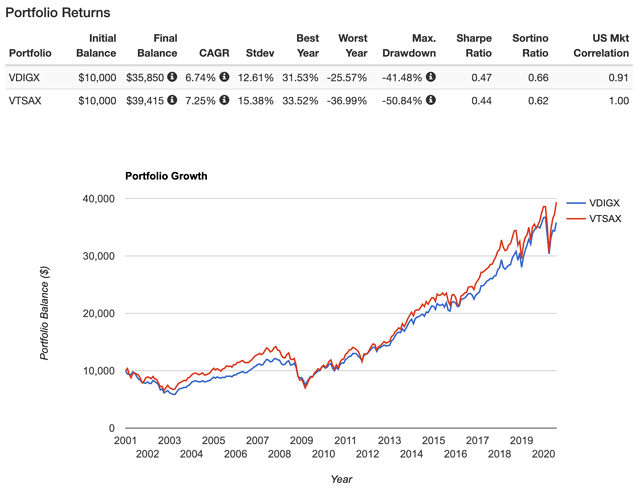

Here’s a look at how it has done compared to VTSAX (The total stock market index fund, with about 4,000 companies) over the last 20ish years:

So you can see they behave PRETTY similarly, but VTSAX has outperformed by about 1/2% per year over a 20 year time period. I would expect that to continue going forward.

One other note, is that VDIGX is a SUBSET of VTSAX. So all 40 of those stocks that you own by buying VDIGX are already in VTSAX. So you’re not getting more stocks or becoming more diversified, you’re just overweighting those 40 stocks relative to the rest of the stock market. (Or in other words, it might appease your dad to tell him you already own Coke, McDonald’s, Johnson & Johnson, etc inside of your total market index fund)

So all in all, VDIGX isn’t BAD and if you invest early and often into it for years you will make a lot of money, but I’d probably go with broader low fee index funds.

Thanks for your detailed reply! While I am not a complete newbie, I was unaware of looking into how many companies a fund has until now. So since I already have both VDIGX and VTSAX in my brokerage account, it sounds like from what you’re saying that it wouldn’t make sense to continue to invest in both since VDGIX is a subset of VTSAX, and maybe I should change funds in my Vanguard Roth IRA too.

It’s not BAD to have both… and it doesn’t necessarily go against logic. It just means you’re “doubling up” on some of the same stuff. Which is good if that’s what you want to do because you believe those 40 companies are especially good or whatever.

But yeah, my preference is broader market, low fee index funds.

But again… it’s more of a fine tuning issue. Broad strokes, buy and hold, put more money in, stay the course, etc. That’s how you win with investing!

Thanks! You must be tired of sounding like a broken record. Which site did you use to graph the returns for VTSAX vs VDGIX?

Also, I think it’d be helpful if you did a post about how to rebalance. People like me find it intimidating! Vanguard’s website says to avoid owing taxes on investments in taxed accounts, you could choose to only rebalance tax-advantaged accounts. I don’t know what to do!