Originally published at: https://www.personalfinanceclub.com/the-devastating-effect-of-fees-on-investments/

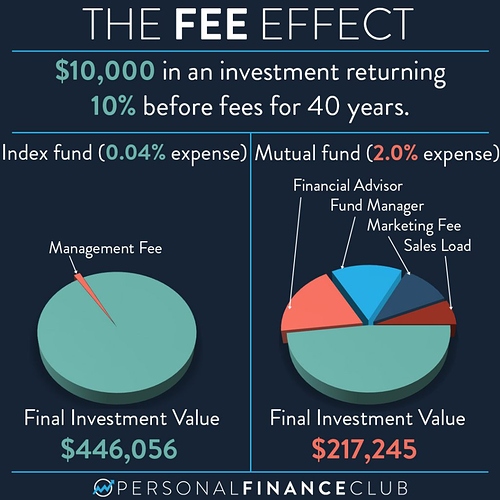

Your eyes do not deceive you. These two charts show the devastating effect of fees compounded over many years of investment.

On the left is a typical index fund with a very low expense ratio of 0.04%. Compounded over 40 years, the fees eat away about 1.4% of the total potential value, leaving the investor with $446,056.

On the right is an example of a mutual fund bought through a financial advisor. The financial advisor often has a incentive to recommend a high fee fund and may charge a sales load (transaction fee) as well. The total 2% fee doesn’t sound terrible, but compounded over 40 years it erodes 52% of the potential growth, leaving the investor with less than half, $217,245.

This is the plain and brutal math of these two fees compounded over time. When you’re looking at any investment, make sure you understand the fees involved.

If you work with a financial advisor, make sure you’re aware of the expense ratio of all of the funds you’re invested in, any annual account fees, monthly maintenance fees, 12b-1 marketing fees, sales loads, etc. Some of the fees may not appear on your statement, but are charged internally in the funds.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram