Hello everyone,

I’m 21, and I have about 100k invested in VTI at Vanguard. I plan to hold it long term, of course.

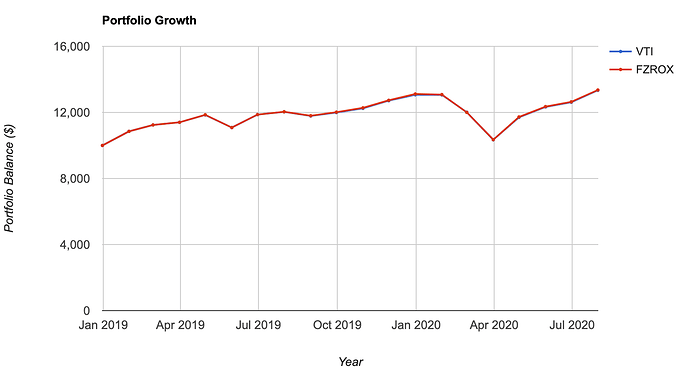

Today, I found out about FZROX, basically Fidelity’s version of VTI. What appealed to me was the 0% expense ratio, compared to VTI’s 0.03% expense ratio.

I know that I would only be saving $3 for every $10,000 I have invested (so like $30/year currently) comparing the difference in expense ratios. However, if I’m holding for 10,20, or even 30 years, I’m thinking that it might be a significant difference in the long run, but I’d like you hear your opinion on the topic.

Should I try to convert everything over to FZROX since it has a 0% expense ratio? Or should I just keep investing in VTI?

I look forward to hearing your guys opinions!