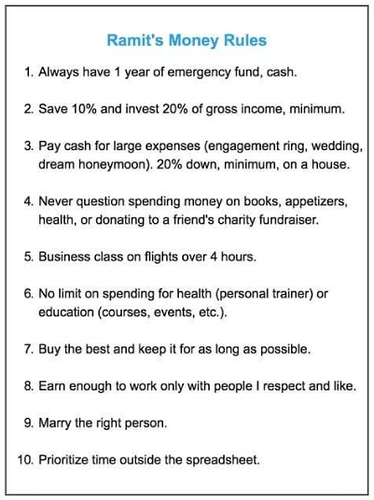

Hey Jeremy, not sure if you’re familiar with Ramit Sethi and his concept of “money rules” (Ramit is great BTW!) - but they are his 10 PERSONAL money rules that he lives life by and encourages others to come up with their own set of money rules as well. These should be personal and not necessarily recommendations for others.

Could you share with us what YOUR 10(ish) money rules are?

For reference, these are mine!

- Prioritize and max out your annual retirement contributions.

- Max out your contribution to your company’s ESPP. Cash out and reinvest in a more diversified portfolio at the end of each period (unless you work at Amazon or Apple).

- When you get a discount: you’re not “saving" money, remember that you’re still spending on something.

- Before you buy a home: RUN THE NUMBERS and factor in the TCO, not just the mortgage cost. Plan to live there for at least 5 years.

- Maximize your earnings. Buy low-cost funds.

- Cut unnecessary reoccurring expenses and negotiate down all of your bills and payments.

- Be frugal, but don’t be cheap.

- Prioritize spending your money on experiences, not things.

- Find and marry the right partner. They will have the single biggest impact on your finances.

- Always have a plan. And a backup plan (prepare for the worst).

Understand if you don’t get to this one but thought it would be interesting!