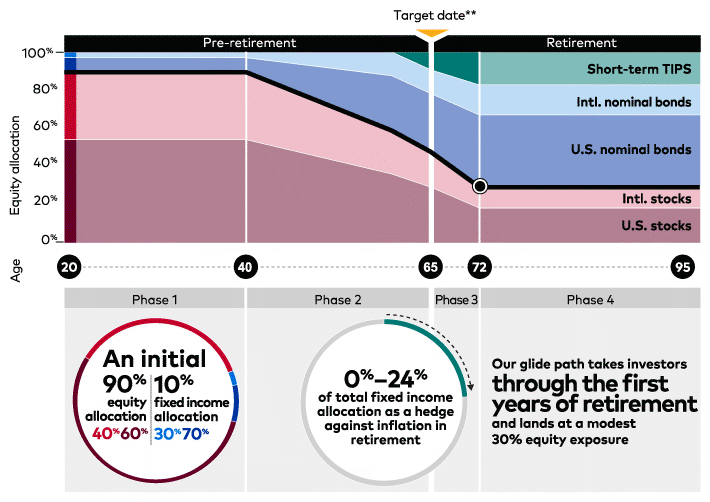

Nothing really… you continue to own it, it keeps growing, it continues to reallocate towards bonds past your retirement age. Broad strokes, most TDIFs are about 50% bonds/50% stocks when the target year hits, and they continue to reallocate all the way down to about 70% bonds and 30% stocks.

Yes, although I think they do close the old ones to new investors. i.e. you can’t start contributing to a 2005 target date fund today, I assume because they want to eventually close those funds as they open up newer ones.

It continues to reallocate after the target year! This is called the “glide path”. Here’s an image that shows Vanguard’s glide path. Note how nothing actually happens around the year of the target date. personally I think these should be named after a birth year, not a target retirement year. (So the 2050 target retirement fund should really be called the “Automatic asset allocation fund for people born around 1985”… that’s probably why they don’t let me name them!)

Source

Yep.

Can’t really give concrete advice on this one. According to the experts who build these, you should be adding zero years… that’s why they made them that way. But if you are a person who makes the critique that the TDIF creators messed up and made them too conservative, then go ahead and add 5 or 10 years! I personally think that’s reasonable.

Depends on the type of account and if you have unrealized gains! If you own it in a taxable brokerage account and have unrealized gains (the value went up since you bought it) then trading it out would cause you to pay tax on those gains. Likely not a huge deal but worth running by a tax helper if the gains are significant. If it’s in a retirement account (like an IRA or 401k) then trading funds never is a taxable event.