Originally published at: https://www.personalfinanceclub.com/what-has-the-best-rate-of-return-a-savings-account-a-home-or-index-funds/

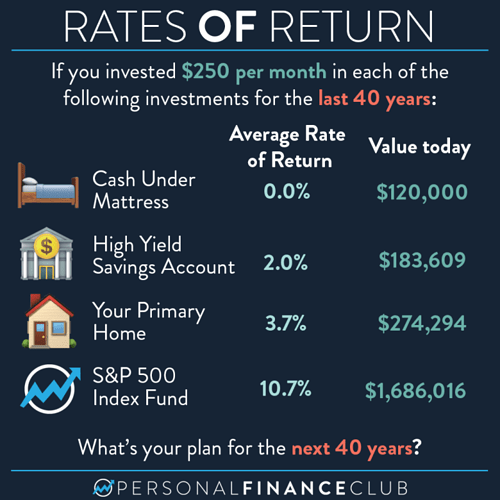

When thinking about where to put your money, I often get questions about which high yield savings account is best. They’re all so low these days it just doesn’t matter.

Cash under the mattress obviously isn’t a good way to go.

And your primary residence is more of a forced savings account than a great investment. The 3.7% rate of return shown here is based on the S&P/Case-Shiller U.S. National Home Price Index which tracks “same home” sale prices. This doesn’t even account for the expenses of owning a home (taxes, insurance, maintenance, realtor fees, etc). If you include those the average return is negative.

Index funds are still king. Buying and holding index funds is the most efficient and effective way to grow your wealth.

When I talk about index fund returns, I often hear “That’s not realistic! What about inflation?!” And for sure, that’s an important factor. A million bucks in 40 years from now won’t be able to buy as much as it would today.

But if you account for inflation, the math is even more ugly for everything but index funds. Assuming inflation of 3% per year, your $120,000 invested under your mattress would be worth only $68,316 today. Your savings account would barely have held. Your house would barely outpace inflation being worth $138,438 (just $18K more than the $120K you put into it). But your index fund investment, after accounting for 3% of inflation would still be worth $800,469. Close to a million bucks. And almost SIX TIMES MORE than the EXACT SAME amount of money invested in your primary residence.

One last caveat: While an S&P 500 index fund is great, I personally think it’s a better strategy to invest in a TARGET DATE INDEX FUND. That has the S&P 500 index fund inside of it and is better diversified.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram