Hey Jeremy!

What would you consider a high fee/expense for an etf? I know vti and some of those etfs have .02%-.04% … those being very good… but what would be Too high in your eyes? And could you possibly provide an example of an etf thAtS on the higher side but still low comparatively ? Thank you again for all that you do!!

Hey @Ogy11g!

Before I answer, can I ask what’s the motive behind this question? Are you looking for a better ETF than the lowest fee versions? Are the lowest fee versions not available to you? Something else?

Hi Jeremy

Im in vti and and will eventually probably get into vxus and bnd eventually… just out of mere curiousity… i understand the built in costs/profits with concentraTed etfs… but what would you say is too much too pay for an expense/fee on an etf? Any other etf you would recommend besides the whole

Market, Snp500, International, or bonds?

Also ive been reading money master the game… and robbins kind of talks poorly of TDIF because they are so new (No real sample and we are guiney pigs) and theres alot of fees that we arent aware of that take place over the 30 year period… its all about index/etf and compound interest but from what i gathered the TDIF are hit harder fee wise? Your thoughts?

Thank you!

Ah, got it!

Well VTI, VXUS, and BND are awesome. And I would consider them to be “extremely low” expense ratios. Anything around 0.1% or lower is “extremely low” in my opinion, and doesn’t necessitate splitting hairs to go lower. Those three are 0.03%, 0.08%, and 0.035%. All lower than my “extremely low” bar.

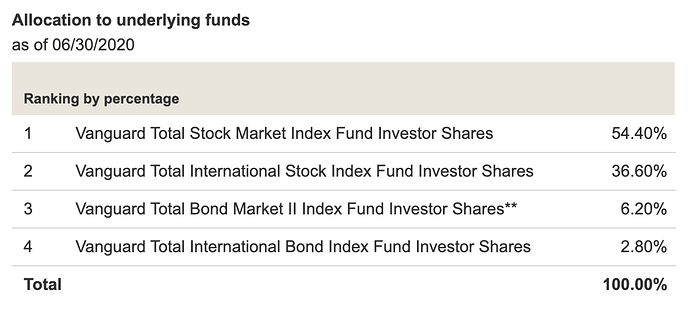

Regarding critiques of TDIFs. Almost all the critiques I hear are conflating them with the higher expense target date funds. Not target date INDEX funds. Target date funds confusingly also are named after years, but have an active manager doing tricky stuff inside. Target date INDEX funds are a very simple basket of a few simple index funds. For example, look inside the Vanguard 2050 TDIF:

It’s literally just a convenient way to buy those 4 things in one package. And since I’m a fan of simplicity, that’s my preferred approach.

That said, a 3-fund portfolio can be every bit as good if you don’t mind managing the allocation of those funds. If that’s your preference, you’ll have me cheering you on!

Awesome Jeremy!!! Thats why i continue to tell everyone i know about you… kind, intelligent, profound, and extremely generous!!! Seriously thank you for all that you do. Dont stop!!! (Im the g11tg on ig) lol.

Sincerely

Anthony

Thank you! That’s very kind!