Originally published at: https://www.personalfinanceclub.com/what-is-an-index-fund/

Index funds are a type of “mutual fund”. A mutual fund is a bunch of money (a fund) owned by a bunch of people (mutual). Back in the day, all mutual funds were “actively managed”. That means a smart manager was paid to take all that money, and buy a bunch of stocks with it at his discretion. People who wanted to invest would put some money into the mutual fund and they would get a piece of all the stocks the smart guy decided to buy. It was a nice way to diversify your portfolio without having to do all the research and trading yourself.

But here’s the problem with actively managed mutual funds. The smart managers charge a high fee for their services. And they’re competing against a bunch of other smart managers who also charge high fees. So all the individual investors are paying a lot of money to trade stocks back and forth and end up with less money than those stocks actually provide.

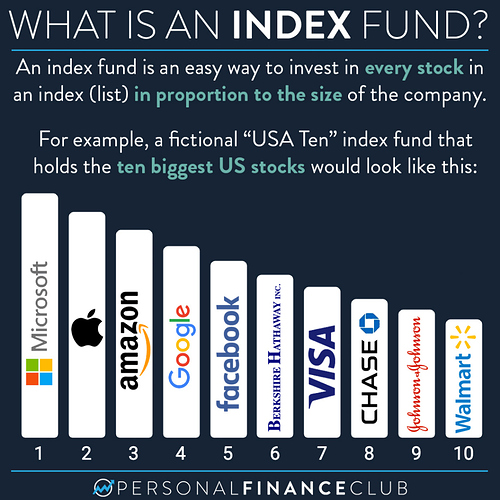

Enter the index fund! Instead of paying a smart manager a high fee, an index fund is a type of mutual fund that just buys EVERY stock in a list. For example, an S&P 500 index fund owns the 500 biggest stocks in the US. It turns out, since the market is “efficient”, all the stocks are priced about right, so buying all of them is a great way to fully diversify and guarantee your fair share of the market growth. Index fund fees are typically 10x-50x lower than actively managed mutual funds, and their performance is almost always better.

Note that my favorite way to invest is in a target date index fund. If you want to learn how to get started buying index funds, check out my Ultimate How To Get Started Investing Guide!

Here’s a video on mutual funds an index funds!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy