Originally published at: What’s the difference between an ETF and a mutual fund? – Personal Finance Club

First of all, I’d like to be clear that those bags on the left are full of rice, not blow, so save your comments you junkies.

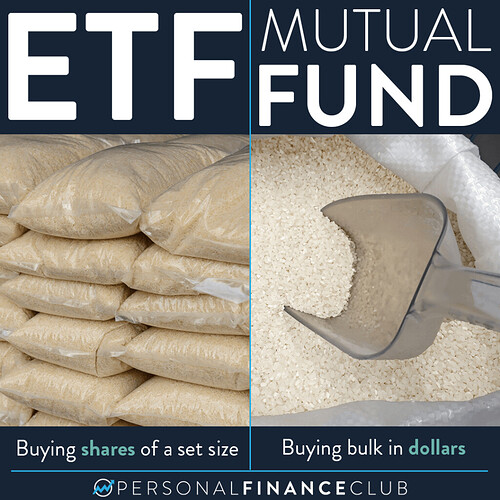

I often get asked which is better, ETFs or (mutual fund) index funds. The answer is that one isn’t better than the other. They both contain the exact same stuff, they only differ in how they trade.

ETFs are bought and sold in shares. For example, VTI is Vanguard’s total stock market ETF and it’s currently trading at $230/share. If you had $500 to invest you would buy two shares for $460 and have $40 left over. It’s like buying discrete bags of rice.

Meanwhile mutual funds are bought and sold in dollars. For example, VTSAX is Vanguard’s total stock market index fund. If you had $500 to invest, you’d just put your $500 in an get $500 worth of VTSAX. It’s like buying rice in bulk.

THEY BOTH ARE THE SAME RICE. Both VTI and VTSAX contain the exact same stocks and will grow at the same rate. One won’t make you more rich than the other.

My preference you ask? I like the mutual fund version of index funds. Here’s why:

1. Investing in dollars is more simple. You don’t have to worry about how many shares you can buy or “cash drag” from that leftover cash.

2. Automated investing. ETFs generally can’t be bought automatically on a schedule since they involve real-time trading.

3. Buy and hold mentality. Mutual funds only trade once/day which encourages long term investing, not jumping in and out of the market.

And yes, I know, many brokerages are now offering partial shares of stocks and ETFs which blurs the line further and invalidates the first point above, but for the sake of learning the difference I still think this is a helpful metaphor.

WANT TO LEARN MORE? Take my course!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram