Originally published at: https://www.personalfinanceclub.com/whats-the-difference-between-an-index-fund-and-an-etf/

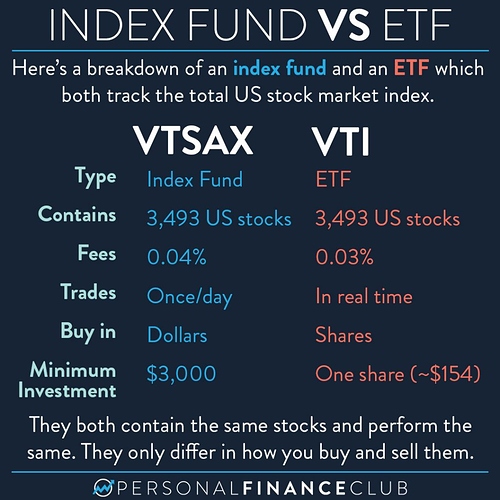

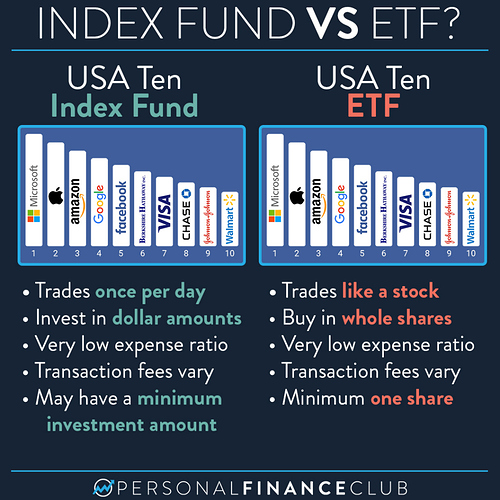

I get this question a lot. ETFs and index funds are nearly identical. The equivalent ETF and index fund (as the example above) contains the exact same stocks and performs exactly the same. The only difference is in how you buy and sell them. ETFs trade like stocks. You can buy and sell in realtime while the market is open. And you have to buy them in full shares. So right now VTI is trading at about $154 per share. If you want to invest $200 you can’t invest that full amount in VTI… you’ll have $57 “left over” after you buy one share.

Index funds only trade once per day, at the close of the market. And instead of buying in shares you invest in dollars. So in the example above, you could put exactly $200 into an index fund and have 0 cents “left over”.

If you buy VTI or VTSAX with a Vanguard account, neither have transactional fees, but some ETFs and index funds may incur fees when you trade. The top brokerages offer lots of no transaction fee ETFs and index funds, so I never buy something that has a transactional fee.

Different index funds also have different minimums, but you can always buy just one share of an ETF so keep that in mind. Fidelity now offers $0 minimum, 0% fee index funds. Fidelity’s 0% fee equivalent of VTSAX would be FZROX.

Personally, I like the index fund version better because I plan to buy and hold for years. So I just want to dump all my dollars in and not worry about trading when the market is open or keeping track of numbers of shares.

And as always, I don’t dump all my money in just a US index fund, I like target date index funds which contain a mix of US, international and bonds.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy