Originally published at: https://www.personalfinanceclub.com/where-can-i-invest-after-maxing-out-my-roth-ira/

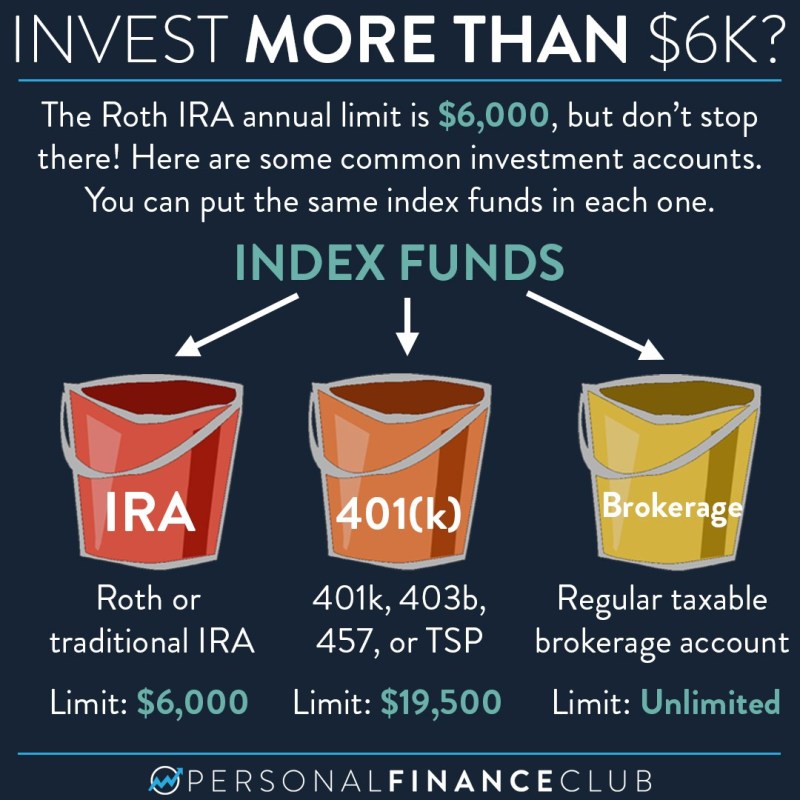

A lot of investors get started by opening up a Roth IRA, which is great! A Roth IRA is a type of account (think checking, savings, etc) but INSIDE of the Roth IRA you purchase investments like stocks, bonds, or better yet INDEX FUNDS. Any growth of those investments is never taxed again (assuming you don’t withdraw the growth until 59.5 years old). Because it’s such a good deal on taxes, the government limits contributions to Roth IRAs to $6,000 per year.

So I often get the question: “OK, but can I invest MORE than $6,000 per year?” I’M SO GLAD YOU ASKED. ABSOLUTELY. A Roth IRA is just ONE type of account in which you can invest. Many employed people have access to an employer sponsored investment account that also offers a tax break. Examples of those are 401k, 403b, 457, and TSP. That contribution limit is $19,500 per year.

If you have MORE money to invest (or you don’t have access or aren’t eligible for a Roth IRA or employer sponsored account) you can always invest in a regular brokerage account! A brokerage account is just a bank account you use to invest instead of just store cash. IRAs and 401ks are just special brokerage accounts that offer a tax break. Personally about 95% of my investments are in a regular brokerage account because I had too much money to fit under the contribution limits of the other two accounts!

As always, reminding you to stay healthy by following the two PFC rules: 1.) Stay at home and 2.) Wash your hands early and often.

– Jeremy

via Instagram