Originally published at: Why buying a home is NOT a good investment – Personal Finance Club

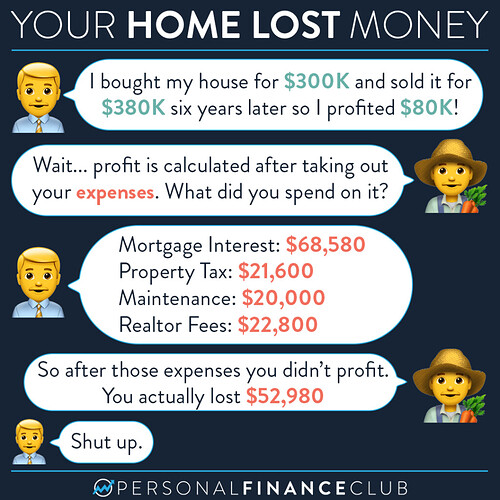

The American dream of homeownership casts a spell on all of us homeowners. We love looking at the current value of our home and telling ourselves this wonderful tale about the great real estate investment we made. It went up in value SO much in just a few short years! What a great deal we made! If we can find deals like this, maybe we should star in one of those home flipping shows! Man, we’re good at real estate. Call me, HGTV.

Meanwhile, we ignore the huge payments we’re making every month just to keep the house up and running. That $800 new water heater? Had to do it. The $8K bathroom remodel? It was really dated! The $5K driveway and the $2K in landscaping? Gotta look good for the neighbors. Oh, and the massive cash we’re sending to the bank every month? Well… we’re building equity!

Primary homes almost always lose value after accounting for their expenses. That’s ok. That’s life. It costs money to have a roof over your head. But don’t fall for the trap that buying more house is a better investment. More house equals more expenses. And if you can rent a modest place at a lower cost than the sum total of your buy expenses, then throw the extra (plus that massive down payment) into an investment so it’s building wealth instead of costing you money, you might end up even further ahead! Likewise, if you can buy more modestly and invest the difference you’ll definitely end up ahead!

I was a renter my entire adult life until the age of 39 when I was well into multi-millionaire territory. I’ve been a homeowner for about two years and it’s been a terrible financial decision. But it’s a nice home and I’m rich, so it’s good for my life. But I’m not kidding myself into thinking it’s a good investment! :)

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram