Hey @diwhitman!

Well, keep in mind both 10% and 1% are both “very low” bond allocation. You’re either 90% stocks or 99% stocks. Either way, almost entirely stocks.

As far as why, I could only speculate, but I’d guess somewhere in New York there’s a room full of analysts poring over historical stock and bond market data, projecting out which asset allocation is more likely to put investors in better shape come the target year and beyond. For whatever reason those analysts at Vanguard and Blackrock came to similar but slightly different conclusions regarding bond allocations. I hesitate to pick a winner and say which is best, but I can easily call them both great and say it would be very difficult to know in advance which will outperform. Or maybe the blackrock guys just wanted to be different and when 1% bonds because nobody likes bonds right now and they’re trying to attract new investors?!

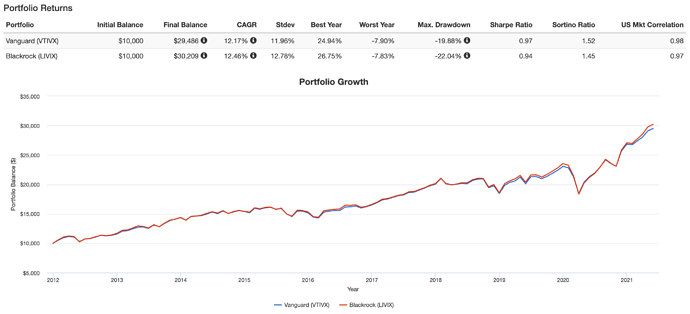

Here’s a look at the trailing performance over the last 10 years. As you can see, it really doesn’t make a difference.

Link to data