Hi all,

Disclaimer before I ask my question - I have been following Jeremy’s advice on investing in Index funds for a while now and have just recently opened a brokerage account with Trading212. I am still learning the gist of the stock market tho, so consider me a complete newbie.

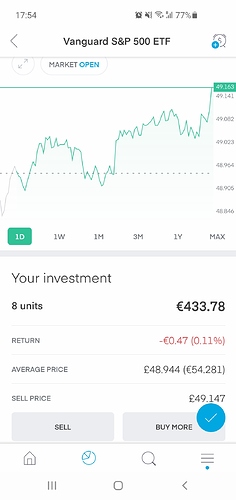

So, I have invested a few hundred bucks in VUSA (Vanguard S&P 500 ETF). I bought 4 units @48.980 and another 4 units @48.908 giving an average price of 48.944. My confussion comes from the fact that the market is now at 49.147 sell price and my return is still negative. Is there a kind soul out there willing to explain to me how to figure out why is my return negative and what market sell price per unit does the market need to achieve for me to get a positive return?

I apologize again if I have formulated my question poorly, please let me know if that’s the case and I will try to provide more info. I am based in Ireland, Europe if that’s of any importance.

Thanks in advance!

A